The #VATMoss and #VATMess hashtags have been trending on Twitter for most of December. The hashtags relate to changes to VAT that are coming into effect on 1st January 2015. These changes may affect the online products Cherryleaf sells.

What’s happening to VAT?

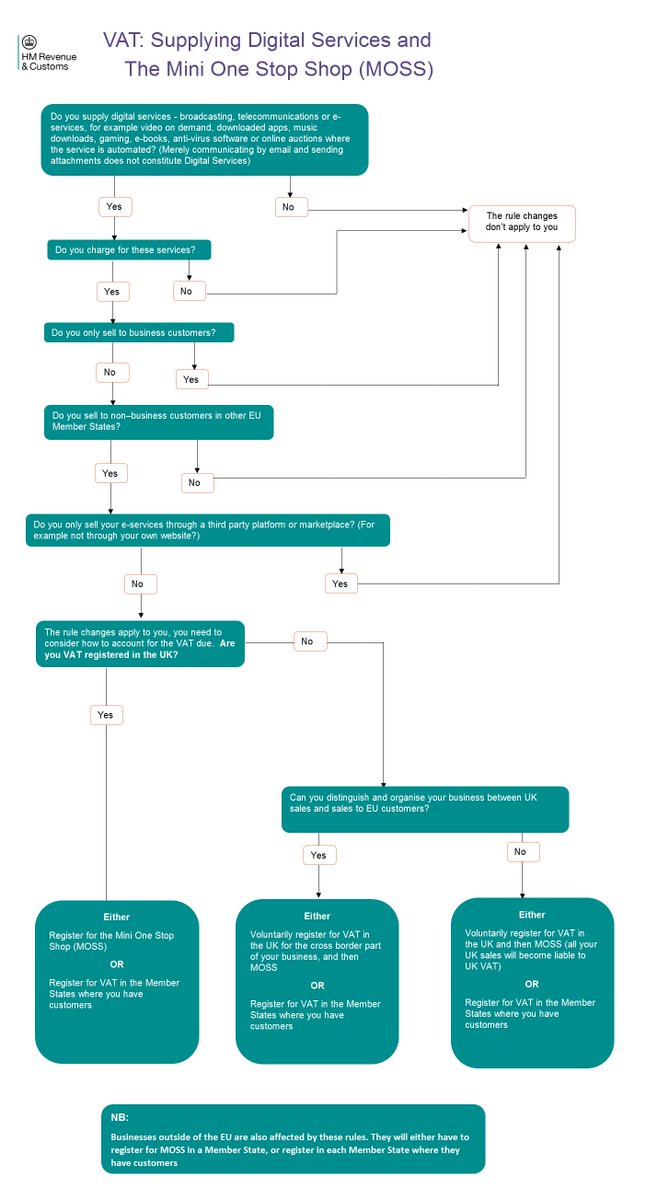

HM Revenue and Customs has been publishing guidance on what’s happening, who’s affected, and what business can do:

“On 1 January 2015 the VAT rules for cross-border B2C supplies of ‘digital services’ (i.e. broadcasting, telecoms and e-services) will change. From that date, VAT must be accounted for in the member state where the customer normally lives, rather than where the supplier of the service is established. This means that sellers of digital services will no longer be able to unfairly undercut businesses in the UK by locating themselves in another EU member state with a lower VAT rate.”

In practice, this means if ebooks have a 25% VAT rate in say, Belgium, and only a 20% VAT rate in the UK, a UK-based seller has to either:

- Charge 25% VAT to any consumers based in Belgium (and register for VAT in that country), or

- Report these sales to HMRC each quarter and pay the 5% difference to HMRC (who then sends the money on to Belgium).

This change has the greatest effect on micro businesses who are not currently registered for VAT, as it this means they’ll face having to complete quarterly “MOSS” returns and possibly paying more tax. For companies already VAT registered, such as Cherryleaf, it means completing an additional return when we do our quarterly VAT reporting.

What is a digital service?

“The changes apply to digital services. These are broadcasting, telecommunications and e-services that are electronically supplied.”

In Cherryleaf’s case, our online training courses consisting of pre-recorded videos and downloadable pdfs plus support from a live tutor are not classified as a digital service. However, our ebooks and the online course consisting of pre-recorded videos (but no tutor support) are classified as digital services.

What will this mean?

This means we’ll need to do more reporting to HMRC and probably pay more tax on overseas EU sales. If the business case doesn’t justify the extra time and cost, we’ll have to look at taking the ebooks off sale. We’ll also have to consider only offering online courses that include support from a live tutor (so they fall outside of the definition of a digital service). In short, no change for the immediate future, but there may be some changes to what we offer later into 2015.

Leave a Reply